Insurance By Coverage

Workers Compensation Ghost Policy

How Does a Workers Comp Ghost Policy Work?

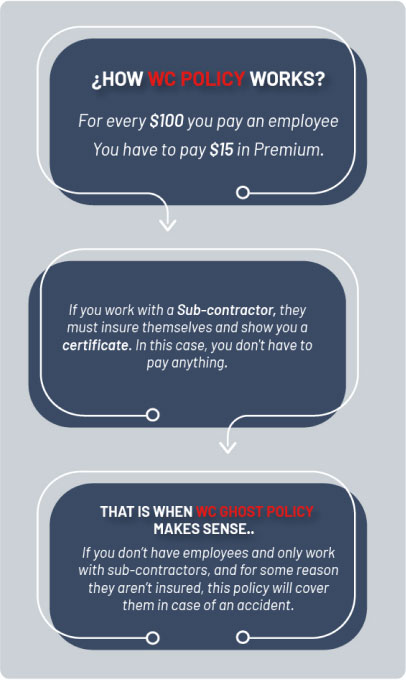

So let’s first think about how workers compensation insurance is billed. Workers compensation is billed by classes of employees and the type of work they do on a percentage basis of payroll.

For example, a painter might have a 15% rate of payroll. This means for every $100 you pay them as your employee (Workers Compensation is meant to cover your employees) you pay $15 in premium. Now if that same painter you pay $100 to is not an employee, but a 1099 subcontractor, and provides you with workers compensation insurance naming your business as additional insured, you would have to pay 0. No problem.

Recommended POLICIES

- Commercial General Liability Insurance

- Commercial Property Coverage

- Loss of Income Coverage

- Equipment Breakdown Coverage

We will find the best coverage at the best price for your specific business and needs.

No Employees? You Still Need Workers Comp Insurance!

I have been told that I need Workers’ Compensation Insurance for a project I am bidding on or have won, but I don’t have any employees. Is this true?

A Workers Compensation “Ghost policy” or Workers Compensation “If Any” policy are the same thing. Both refer to a workers’ compensation insurance policy where there is no employees and the owner is excluded. It sounds bad to pay for an insurance policy that only covers the owner and the owner is excluded. The logical question would be “What am I paying for then?”

The answer to this question is that you are paying for any sub-contractors throughout your policy period that do not provide you with proof of insurance “certificate of insurance” naming you as additional insured.

5 Best Reasons To Get Workers Compensation Ghost Policy

Protect Your Reputation

Insurance protects against employees misrepresenting your company.

Plan For The Future

Insurance protects against unforeseen risks.

Lawsuit Protection

Vital protection in a litigious society.

Prevent Financial Ruin

Insurance helps your business survive a disaster.

Get Peace of Mind

Insurance that protects the little guy.

An Example Of Workers Comp Insurance

Now you know if they are your employee and you take out taxes, you will have to pay 15 dollars for every 100 dollars of payroll. If you pay your painter as a sub-contractor and they have their own workers compensation insurance, you would have to pay zero.

The problem arises when you have a 1099 employee that does not have workers compensation insurance. In this case, they fall under your policy and you have to pay for workers compensation as if they were an employee.

The reason for this is that if they were injured, your “if any” policy would cover them and pay for injury, lost wages, retraining etc. that is covered under workers compensation insurance.

The insurance company is on the risk for your sub-contractor getting hurt and on your audit, after your policy period ends, they will charge you for this risk. If you are not planning for this, it is a bad day. So let’s look at how insurance is billed and what this audit is about.

Do you need Business Insurance?

Call Us: (888) 910-0520

Projected vs Actual

Your application is simply a projection of your business for a year in regards to number of employees, payroll, payroll class, coverage and gross revenue. It does not reflect what your premiums will be in actuality. This is done every year about two months after the end of the policy period at audit which is required per your application. The premium you agree to at application really means nothing until it is audited.

At audit, if your payroll is less than what was projected you would get money back. If your payroll is more than what is projected you will have to pay more. Most people understand this and agree with this. The major problems I have run into in audits is lack of certificates of insurance naming you as additional insured. Simple as that.

Uninsured Subcontractor = Employee

That said, if you hired our painter and paid him 30,000 and he did not have insurance, you would owe 15% of that being 4500 dollars and the money is due within 30 days or your policy cancels. If you let this happen, you will be in a database of unpaid audits by your name and birthday and it will not be possible for you to obtain workers compensation from any company, for all insurance companies subscribe to this database.

This is the long and short of the if-any or ghost policy. Small Business Liability knows that this can be a difficult concept to get your head around. It is also difficult to work out what you should be paying for a workers compensation ghost policy. We are here to help.

What Does A Workers Compensation Ghost Policy Cost?

The cost of these policies typically runs about $1200 but does depend on what state you need it for. You will have to incur this cost and this cost is protecting your customers as much as you.

It’s important that you figure out the cost of your labor correctly and pass that cost on to your customer. In our painting scenario, it would be a good idea to add 20% on to your labor costs for insurance.

Evaluate

This coverage protects against claims of alleged or actual bodily injury or property damage to third parties (these include visitors, tenants, delivery persons, etc.). General liability coverage is important in protecting you from lawsuits.

Be Millitant

Be militant about your certificates of insurance. If someone does not have insurance, you will have to charge them for it. Simple as that. If you do not, they will rarely come forward with money when you are audited.

Plan Ahead

Set the money aside for the additional audit. If you plan for it, you can pass this cost onto your customers.

Benefits of getting insured by

Small Business Liability.com

Small Business Liability.com has created a comprehensive guide to the insurance required before starting a business for each specific profession listed below.

If you have any questions, we are staffed with experts in the insurance field who are willing to help.

Our experts can guide you to the right coverage for your business.

We know your time is really tight, but you can set up a call at any time; we are 24/7.