Commercial Auto

Commercial Vehicle Insurance For All Types of Small Business

If you own any business that involves the use of vehicles you need to purchase an affordable Commercial Vehicle Insurance policy to protect your business. In the insurance business the name Commercial Auto Insurance is often generically used, even though these policies cover more than autos.

Small Business Insurances

- Property Damage Liability Coverage

- Bodily Injury Liability Coverage

- Personal Medical/Injury Payments

- Comprehensive Coverage

- Collision Coverage

- Underinsured/Uninsured Motorist Coverage

What Is Commercial Auto Insurance?

Commercial Auto Insurance is specialized insurance that covers vehicles that are used for your business. Commercial vehicle insurance policies cover property damage and liability coverage. The coverage amounts and types of usage are for situations not covered by a personal auto insurance policy.

It covers many types of commercial vehicles, such as cars used for business purposes, to every other variety of commercial trucks and vehicles that can be used in the operation of a business. In the next few paragraphs you will learn what makes Commercial Auto and Personal Auto different. So if you want to save money keep reading.

What Vehicles Are Covered By Commercial Auto Insurance?

Cars, Box trucks, food trucks, work vans, and dump trucks are just a few of the many types of commercial vehicles. All of these will require cheap Commercial Auto Insurance. They include coverage for employees operating the vehicle.

In numerous instances, the equipment inside will also be covered from loss. There are many names for this coverage such as commercial auto insurance, commercial car insurance, truck insurance and commercial vehicle insurance.

It is a common misconception to think that this type of insurance only applies to large vehicles. If you use a car, SUV, or van for income-generating purposes, you need to have commercial auto coverage. If you have one of these types of vehicles, and you only have personal auto coverage, there is a good chance your claim may be denied if the accident occurs while you are using the vehicle for business purposes.

What Does Commercial Auto Insurance Cover?

Commercial Auto Insurance provides coverage for cars and any other motorized vehicles that are used for business purposes. Commercial Auto Insurance includes most of the same coverage as standard auto insurance. Commercial Auto Insurance also includes coverage specific to the needs of people who use their cars or trucks or other vehicles in the operation of a business. Semi trucks, box trucks, and dump trucks are clearly commercial vehicles, and they need Commercial Auto Insurance.

What may not be so clear is if you use your car or truck for work. If the vehicle will need a commercial auto insurance policy to cover you while you are using it for business-related purposes. This coverage is also available to cover your employees. It can even cover you when they are driving their personal vehicles.

Commercial Auto Insurance is generally more expensive than personal car insurance. There are ways you can qualify for discounts just like with your regular personal policy. Commercial auto insurance includes many of the same coverage components as personal car insurance:

Property Damage Liability Coverage

Pays for the damages due to property damage to vehicles and other property in the event of a covered claim. An often overlooked benefit is that it also covers your court and defense costs if legal action is taken against you or your business.

Liability coverage protects you from damage you cause in your vehicle, and collision coverage and comprehensive coverage protect your vehicle itself, no matter who caused the damage. It also provides coverage like non-owned vehicle coverage, which extends the coverage when your employees use their vehicles for your business purposes.

Bodily Injury Liability Coverage

Covers damages that are related to the bodily injuries to others that are part of a covered claim. It also provides coverage for legal expenses.

Personal Medical/Injury Payments

If you are in a car accident, medical payment insurance can help cover you and other passengers in the vehicle no matter who is at fault

Comprehensive Coverage

Pays for a covered vehicle that is damaged by non-collision incidents that you have no control over.This includes coverage if the vehicle is stolen. It also provides protection against vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

Collision Coverage

Collision coverage pays for the cost of repairs to your vehicle if it is hit by another vehicle. It may also help with the cost of repairs if you hit another vehicle or object.. The maximum amount it will pay is the actual cash value of your vehicle.

Good Advice

If you have a loan or lease a vehicle you may want to purchase gap insurance. This will pay the difference between the amount owed on the loan/lease and the actual value of the vehicle at the time of the loss. If you do not have this coverage you will be responsible to pay the difference to the lender if the insurance payoff is not enough.

Underinsured/Uninsured Motorist Coverage

Uninsured coverage protects you if you are in an accident with a driver who has no auto insurance. Underinsured motorist coverage protects you if you are in an accident with a driver who does not have enough insurance to pay for the damages or injuries they caused. If you suffer a hit-and-run accident, you can file a claim against your uninsured motorist coverage.

If you only drive to and from work, you do not need commercial auto insurance. Your personal auto insurance will cover that. If you are a store owner that uses their car for deliveries, or a contractor who drives a truck filled with tools and supplies, you will need a commercial auto policy to protect you.

Property Damage Liability Coverage

Pays for the damages due to property damage to vehicles and other property in the event of a covered claim. An often overlooked benefit is that it also covers your court and defense costs if legal action is taken against you or your business. Liability coverage protects you from damage you cause in your vehicle, and collision coverage and comprehensive coverage protect your vehicle itself, no matter who caused the damage. It also provides coverage like non-owned vehicle coverage, which extends the coverage when your employees use their vehicles for your business purposes.

Do you need a Business Insurance?

Call Us At: (833) 919-2886

How Much Does Commercial Auto Insurance Cost?

There is a huge variance in the premiums of Commercial Auto Insurance policies. There are a number of factors that influence the cost. The following are the main factors.

Number of Vehicles

The more vehicles that your policy will cover drives up the cost. This is because of the increased risk of loss with more vehicles on the road.

Type of Vehicles

The bigger and heavier the vehicle the higher the cost. For example, a HVAC company would have a much lower rate than a large excavating company that operates heavy equipment. This is because there is a much greater probability of a greater loss when a large truck is involved in an accident as opposed to an accident with a van.

Number of Employees

The more employees you have driving vehicles increases the chances of having claims.

Amount of Revenue

The more business you do increases the likelihood of claims no matter how careful you are.

Location of Business

Where you are located makes a big difference. Generally the more liberal the state the higher the premiums. The rates for a small business in New Jersey can be 2 to 3 times what the same business would pay if they were located in Texas. Further even the City or specific area you operate in like the 5 boroughs in New York will cause your premiums to increase.

Driving Records

You will be required to provide driver’s license numbers of all employees that will be operating vehicles. The insurance company will then check out their records with the DMV. Just like personal auto insurance the more tickets and accidents, the higher the premium. For a policy limit of $1 million, the cost of Commercial Auto Insurance for a standard vehicle is around $800 to $2,200 per year. Limousines around $5,500, Delivery/Cargo vans $3,500 and Semi-trucks $9,500 for an owner operator.

Good Advice

If you operate a fleet of vehicles you should review the driving history of your employees. For example, upon reviewing the history it shows that Johnnie Walker has 2 DUIs on his record and Bubba Watson has numerous moving violations. By assigning them other duties that do not include driving a large fleet operator can see their premiums decrease as much as $50,000 a year. It is also a good idea to let your employees know that keeping a clean driving record is important.

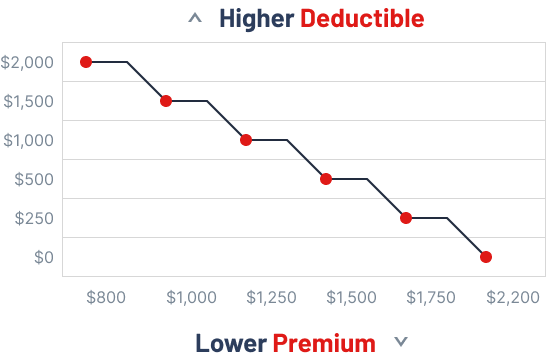

How Do Commercial Car Insurance Deductibles Work?

The deductible on a commercial car business insurance policy works the same as it does for personal auto insurance. The deductible is the amount you will pay when there is a claim on your policy. The higher the deductible the lower the premium.

What is Hired and Non-Owned Auto Coverage

Hired Auto Coverage

This coverage protects you against claims from the use of leased, rented, or borrowed vehicles by you or your employees that are used for business purposes.

Non-Owned Auto Coverage

This covers employees or others who use their vehicles for your business, such as going to pick up supplies or going out and picking up food for the crew.

Is Commercial Auto Insurance Expensive?

When getting quotes for a Low-Cost Commercial Car Insurance policy, you will find it to be more expensive than a personal car insurance policy.There are several reasons for this: it provides different coverage, but also, people’s professional driving habits differ from their personal driving habits.

The amount of risk an insurance company assumes when insuring a business is greater than the amount involved when insuring an individual driver.

Commercial Auto Insurance Commercial vehicles are generally more expensive than personal vehicles as well. Most commercial vehicles are late-model versions that must carry full coverage insurance.

With a personal auto policy, older vehicles often will have only liability coverage. Specialty vehicles also make commercial car insurance more expensive. Certain types of businesses require modifications to vehicles that can make them expensive to insure.

Moreover, if your business requires you to transport valuable items, you need to make sure they are covered. All of these factors contribute to the higher price of Commercial Auto Insurance.

Oftentimes, Business owners are required by contract to have larger limits of liability coverage. If you are doing work for certain companies, the contract may call for specified limits. In any case, a business must be very careful to protect its assets from litigation that might result from a driving mishap. While this may result in an increased cost, it also brings increased protection.

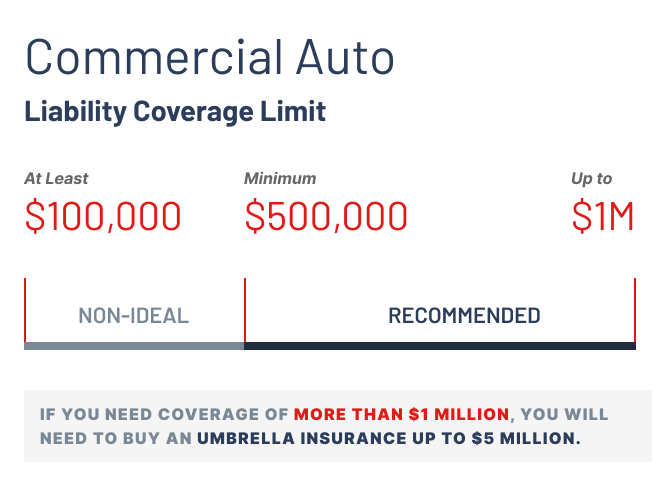

How Much Liability Coverage Do You Need?

There are no hard and fast rules around how much commercial auto coverage you need. You should have at least $100,000 commercial auto liability coverage per vehicle. We recommend a minimum of $500,000 up to a maximum of $1 million.

Just ask yourself the following question, how much money would you be willing to pay for any sort of damages that exceed your coverage limits? Remember, the higher the limits on commercial auto insurance, the more likely your policy will have an opportunity to pay damages.

For example, if your current Commercial Truck Auto Insurance policy covers you for $500,000, and you are successfully sued for $1 million, you will have to pay the outstanding $500,000.

Who Needs Commercial Auto Insurance?

As a business owner, you need the same kinds of insurance coverage for the car you use in your business as you do with a car used for personal purposes. These include liability, collision and comprehensive, and coverage for uninsured motorists. Many small business owners use the same vehicle for both business and personal use. It is important to have affordable Commercial Auto Insurance.

Affordable Commercial Auto Insurance For Business

If you rely on vehicles that are used in your business to provide you with a livelihood you need Cheap Commercial Auto insurance. If you are a smaller business that just has one van used for business and pleasure or a large Business with a fleet of vehicles you need to have Commercial Auto Insurance. This will give you the peace of mind that the assets you worked so hard to get are protected from loss.

Do You Need Commercial Auto Insurance?

Business owners who use their personal vehicles for work should know that their personal auto policies won’t cover any accidents, damage, or injuries that happen because of any income-producing activities. If you use your vehicle primarily for work purposes and only have personal auto insurance, you could be personally on the hook in the event of an accident.

Ask yourself these simple questions:

- Are the vehicles owned or leased by your business?

- Do any of your vehicles have any modifications or other equipment installed used in your business activities?

- Do you use your vehicle for work purposes such as transporting equipment or supplies?

- Do your employees use any of your vehicles on a regular basis?

If you answered yes to any of the questions above you may need to consider commercial auto coverage.

Do you need Business Insurance?

Call Us: (888) 910-0520

Things to know before purchasing your commercial auto insurance

What to ask your insurer before getting your commercial auto insurance.

How many cars and drivers will your commercial auto insurance cover?

#1 – What are the benefits of fleet insurance?

Commercial auto insurance companies usually have different coverage types based on how many cars and drivers you need covered. By getting a type of insurance called fleet insurance can be less expensive than getting a commercial auto insurance for each car since they each have policies.

Under a fleet insurance policy, the vehicles are insured as opposed to individual drivers. This gives you greater flexibility over who can drive which vehicles. You can just assign drivers to different vehicles as the need arises .

# 2 – What is the definition of the policy of using your car for business?

The policy you use for personal vehicles has the exclusion for coverage for commercial uses while commercial auto insurance will establish a definition for commercial use of the car. That is why you need to make sure that your policy has everything covered for your business vehicles and discuss this with your insurance agent. Remember personal use is covered for a business-owned vehicle under your commercial auto policy.

How Can I Lower my Commercial Auto Premium?

There are several ways to reduce premiums, including hiring qualified drivers with good driving records, opting for higher deductibles, and installing safety devices such as car alarms, a GPS system, and airbags. Stressing safety with all employees will also greatly reduce future insurance costs.

Benefits of getting insured by

Small Business Liability.com

Small Business Liability.com has created a comprehensive guide to the insurance required before starting a business for each specific profession listed below.

If you have any questions, we are staffed with experts in the insurance field who are willing to help.

Our experts can guide you to the right coverage for your business.

We know your time is really tight, but you can set up a call at any time; we are 24/7.