Insurance By Trade

Computer Repair Business Insurance

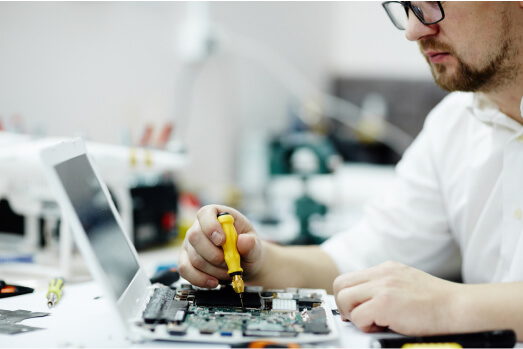

Computer Repair Business Insurance

Most households and businesses have numerous electronic devices. So on any day you’ll see laptop computers, desktop computers, tablets and smart phones. In fact, as of February 2019, 74 percent of Americans own a desktop or laptop computer. This can keep any computer repair business busy.

However, there are risks involved when you have a computer repair business. As a small computer business owner you face risks every day. And it doesn’t even matter where you operate. It can be from a shop or workshop. You may even visit your customers’ offices. Whether you travel to them, or they come to you, your business is at risk. Isn’t it time to consider insuring your interests?

Recommended POLICIES

- Commercial General Liability Insurance

- Commercial Property Coverage

- Loss of Income Coverage

- Equipment Breakdown Coverage

We will find the best coverage at the best price for your specific business and needs.

Why have a Computer Repair Business Insurance?

Get good computer repair business insurance with a Business Owners Policy

A Business Owners Policy is designed for small to medium sized business with limited exposures like offices or small retail outlets Does this sound like your business?

The Business Owners Policy includes two or more types of coverages, packaged together in one policy. General Liability Insurance is necessary for all commercial businesses as it provides third-party bodily injury and property damage coverage.

Commercial Property Insurance applies to structures owned (or where coverage is required by lease) as well as fixtures, permanently installed machinery and equipment, personal property used in the course of doing business, furnishings, as well as inventory or stock.

5 Best Reasons to Get Computer Repair Business Insurance

Protect Your Reputation

Insurance protects against employees misrepresenting your company.

Plan For The Future

Insurance protects against unforeseen risks.

Lawsuit Protection

Vital protection in a litigious society.

Prevent Financial Ruin

Insurance helps your business survive disaster.

Get Peace of Mind

Insurance protects the little guy

More about Computer Repair Business Insurance

Even if you haven’t given it much thought, your computer repair business carries its own set of risks. Fortunately, you can tailor your computer repair business insurance to cover your specific risks.

So, there are many other coverages that can be added to your Business Owners Policy. But because it is difficult to know what policies are best, small business owners often need help deciding between policies. how do you know what you need? For instance, what other coverage should be added to your Business Owners Policy? It is also important to get the best rates. We can help you with this.

Do you need Business Insurance?

Call Us: (888) 910-0520

“It will never happen to me!”

Are you prepared if it ever does?

Accidents happen. Things go wrong. Even a simple accident can mean big trouble. For instance, having a client slip in your computer shop can leave your small business reeling from legal bills and a lawsuit. However, the good news is that your computer repair business can be protected from potential financial loss.

But it can be difficult to know what kind of insurance coverage you need for your computer repair business, and what you don’t. Nevertheless you shouldn’t worry because we can give you peace of mind. Experienced Small Business Liability agents are ready to answer all your questions. It is our business to get you comprehensive insurance coverage at the best possible price.

What if…

you drop a client’s computer? What if there is a fire at your workshop? Who is liable when one of your employees spills a drink on a client’s laptop? Who pays when computers in your possession are stolen from my car? ”

With the many risks involved in a computer repair shop, small business liability insurance is a must.

Take action! Get a quick quote for the types of insurance you need. Coverage can be in place in as little as 24 hours. Give us a call to discuss the best insurance for your small business!

Which Coverages we do provide to your business?

Commercial General Liability Insurance

This coverage protects rental property owners against claims of alleged or actual bodily injury or property damage to third parties (these include visitors, delivery persons, etc.). The general liability coverage is important in protecting you from lawsuits.

Commercial Property Coverage

This insurance coverage will protect your buildings and structures like offices, and garages, and storage buildings .

Loss of Income Coverage

This insurance coverage reimburses business owners for the loss of income due to damage by a covered loss (like fire or storm).

Professional Liability Insurance

Professional Liability sometimes called “errors and omissions coverage” designed for computer repair businesses, if for example, work you perform leads to a breach of data for your customer. This coverage helps pay for the costs associated with these types of suits.

Benefits of getting insured by

Small Business Liability.com

Small Business Liability.com has created a comprehensive guide to the insurance required before starting a business for each specific profession listed below.

If you have any questions, we are staffed with experts in the insurance field who are willing to help.

Our experts can guide you to the right coverage for your business.

We know your time is really tight, but you can set up a call at any time; we are 24/7.