Talk to roofing companies, and they will tell you stories of roofs damaged from wind-driven rain, hail, high winds, ice dams, and other natural disasters.

Storms can happen anywhere, and severe storms are becoming more common. Research indicates that as the climate changes, there will be 20% more severe storms for every degree the earth’s average temperature rises.

While the national weather service and storm chasers alert the public as soon as they have hinted that a storm is imminent, you can’t always avoid storm damage. Additional storms can cause damage in many ways, but roofs are often the first thing to be damaged on a home or construction site.

But what should you do if you think you have storm damage on your roof because of a severe storm? We’ll walk you through the process of assessing the damage and filing an insurance claim.

Roof Storm Damage Checklist: 5 Things To Do If A Storm Damages Your Roof

There are five steps on the roof storm damage checklist that will lead you through the process of recovering from storm damage and restoring your living space to being functional.

Assess the Damage

Storm damage on your roof can be the result of hail damage, wind damage, or a tree falling on the roof. Heavy rains and other types of rough weather can also affect your roof.

Once the storm has stopped, you should either climb up on the roof yourself or hire a roofing contractor to assess the storm damage to your roof. You need to be careful if you are planning to inspect your roof on your own, since a storm-damaged roof can be a dangerous place.

You need to identify roof damage and the type of roof repair that you’ll require. You should take notes so you can pass the information about obvious signs of storm damage to your homeowner’s insurance provider.

Your roof inspection should include all the roof’s surfaces, including an evaluation of the roof deck, looking for damaged shingles, and looking for missing flashing. A leaking roof can cause other types of property damage and should be evaluated as soon as possible after the storm.

When assessing the exterior, you should look for standing water, proper drainage, and clogged gutters.

Contact Your Insurance Company

Once you’ve contacted your insurance company to file a claim for possible storm damage, most insurance companies will send an insurance adjuster out to your home to evaluate the roof damage and assess any other damage to your home’s exterior. If they can’t get an adjuster onsite quickly, they will ask you to document the storm damage through pictures and possibly having a roof inspection.

Insurance adjusters are trained in identifying signs of damage from severe storms, including the impact of hail, strong winds, and water leaks.

While waiting for the insurance company to assess the damage, you might need to put in place temporary fixes such as tarps and other waterproofing material to keep water from entering your building. You will also want to make sure that the space is still suitable.

Repair the Damage

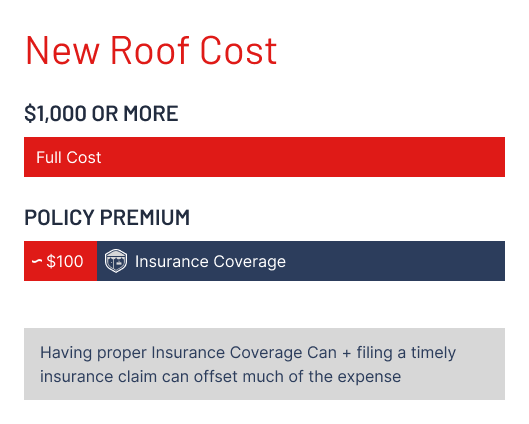

New roofs can cost thousands of dollars (if not tens of thousands). A roofing contractor in your area can provide an estimate based on your local market. Even repairing a few missing shingles can cost hundreds of dollars in labor expenses. Having proper insurance coverage and filing a timely insurance claim can offset much of the expense.

Regardless of the cause of the damage to your roof, you’ll need to get the roof repaired quickly before water gets inside the structure and causes structural damage. You should start by removing any standing water that can cause additional damage to your property. Depending on the severity of the storm damage, you may need to replace a few broken shingles or you may need an entirely new roof.

You always want to ensure that you are working with a trusted roofing contractor to ensure that the repairs are done properly. This is especially important if the storm damage was severe enough to require a roof replacement.

Keep Track of Expenses

While you might be dealing with unexpected living conditions and further disruptions to your everyday life after a major storm, it’s important to keep meticulous records of your spending on roof repairs.

The insurance company will need receipts in order to process your insurance claim. Keep in mind that eligible expenses might include the removal of larger tree limbs, repairs for water damage on the interior property, and debris removal.

Get Reimbursement from Your Insurance Company

After assessing the roof damage, working with a roofing contractor, and resuming life as normal, you need to file the insurance company for the repairs. Each company will have its own process for obtaining reimbursement.

You will often need to submit pictures of the roof damage (be sure to take up-close pictures in the event of hail damage which can be hard to spot) and all the receipts for repairs. You may also need signed work orders from your roofing contractor for storm damage mitigation.

How to Find The Right Insurance Company

With severe weather happening more often and with your roof vulnerable to the elements, you need to ensure that you have a proper homeowner’s insurance to cover your wallet from spending on extensive repairs.

Hundreds of companies claim to sell insurance that covers your home’s roof from severe damage caused by storms, but how do you find the right company for you? You need to make sure that you are buying insurance from a reputable and experienced company like Small Business Liabilty.com that will cover you and your belongings if a storm causes severe damage to your roof.