Insurance By Trade

Tavern Insurance

Tavern Insurance

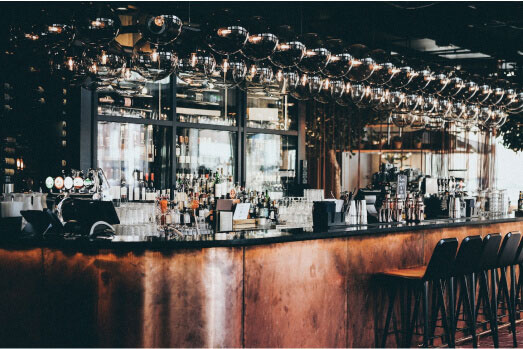

Your Tavern is the place where people gather to spend quality time with their friends, watch the game or maybe seal a business deal with a couple of drinks in hand.

This kind of celebration is the joy of your business, but they could get out of control fast when you mix them with a couple of shots in a small place.

When a couple of overly intoxicated friends start a fight that gets out of control hurting themselves in the process your business could get involved in claims.

Recommended POLICIES

- Commercial General Liability Insurance

- Commercial Property Coverage

- Loss of Income Coverage

- Equipment Breakdown Coverage

We will find the best coverage at the best price for your specific business and needs.

What it is Tavern Insurance?

Maybe someone drinks too much in your Dram, sits behind the wheel, and gets involved in a car accident. In this case, your company could be liable for the damages caused to your clients and others involved.

Bars and Taverns have the responsibility to follow the respective liquor law running in the state they are operating, which means that your bartender or server must be aware of your customers to not over-serve them.

It’s not a bad idea to hire a security guard or bouncer to prevent any altercation between your patrons and insurance to avoid liability claims. Some of the insurance coverage you should get as the owner of a Tavern are:

5 Best Reasons to get Tavern Insurance

Protect Your Reputation

Insurance protects against employees misrepresenting your company.

Plan For The Future

Insurance protects against unforeseen risks.

Lawsuit Protection

Vital protection in a litigious society.

Prevent Financial Ruin

Insurance helps your business survive disaster.

Get Peace of Mind

Insurance that protects the little guy.

What Tavern Insurance Do I Need?

If you own a tavern, you will be the host of a lot of important events in the life of your clients. You’ll receive people celebrating their birthdays, childbirths, a raise for the employees of the company around the block, or the distressful happy hour after a long day at work.

Probably a few heartbroken people would come to speak with the bartender about their breakup as well. Don’t let the claims taint those amazing memories made at your business, get in touch with one of our agents and get a free quote right now.

Some of the insurance coverage you should get as the owner of a Tavern are:

Liquor Liability Insurance

The Liquor Liability Policy is the specific insurance that every business that sells or serves alcoholic beverages should have. The insurance covers you from property damage or physical injuries caused by customers intoxicated at your Tavern and third-parties involved. For example, if a patron gets over-intoxicated at your establishment and creates a car accident heading home this policy covers your business for:

- Legal fees

- Settlements

- Medical costs

Sometimes, liquor liability insurance does not include coverage for injuries caused by fights or assault. In that case, you should also get a Battery Liability Policy.

Assault and Battery Liability Insurance

In the event of a claim filed against your Tavern due to a fistfight, the Assault and Battery Policy will take care of the payment of legal fees and settlements resulting from the confrontation.

Product Liability Insurance

The Product Liability Policy offers coverage to claims made from clients that present some form of personal injury caused by one of the products sold at your business. For example, if one of your whiskey bottles is tainted and the bartender serves that beverage to one of your clients and that customer gets alcohol poisoning. This insurance covers the punitive fees and the medical expenses generated from such claims.

Food Spoilage Coverage

If your Tavern serves food on the menu, this policy is for you. The Spoilage policy covers your business from any income loss due to food spoilage caused by contamination, an equipment malfunction, or a prolonged power outage.

Building Coverage

If you own the building where the Dram is located, you’ll need this insurance coverage having your back. The Building coverage protects the property from damages caused by extreme weather, an act of vandalism, or fire among others. If you are renting the place is the landlord responsible for acquiring the policy.

Equipment Breakdown Coverage

When there is a power surge or outage occurs the pieces of equipment of your tavern could present failures. This failure could represent a severe loss of revenue and could interfere with the normal operation of the business. The Equipment Breakdown Coverage covers the cost for:

- Repairs

- The extra cost of rush repairs

- Temporary repairs

- Lost business income due to broken-down equipment

- Property damage liability costs

Lost Income Coverage

In the event of a sudden closure of your company because of a covered claim, this policy will provide compensation for the revenue that your Tavern should have earned if we’re open. Meaning that you can continue with the regular payments of your employees and rent if you don’t own the building.

Do you need Business Insurance?

Call Us: (888) 910-0520

Benefits of getting insured by

Small Business Liability.com

Small Business Liability.com has created a comprehensive guide to the insurance required before starting a business for each specific profession listed below.

If you have any questions, we are staffed with experts in the insurance field who are willing to help.

Our experts can guide you to the right coverage for your business.

We know your time is really tight, but you can set up a call at any time; we are 24/7.